Amazon.com: The Conjuring & Annabelle DVD Scary Paranormal Horror Thriller Movie Collection : Movies & TV

Amazon.com: The Conjuring & Annabelle Horror Series: 4 Movie DVD Collection (The Conjuring 1 & 2 / Annabelle / Annabelle: Creation) + Bonus Art Card : Vera Farmiga, Patrick Wilson, Annabelle Wallis,

Movie 43 - Extended Version : Stone, Emma, Banks, Elizabeth, Butler, Gerard, Gere, Richard, Berry, Halle, Jackman, Hugh, Faris, Anna, Bibb, Leslie, Bosworth, Kate, Duhamel, Josh, Bell, Kristen: Amazon.com.be: Movies & TV

Amazon.com: Annabelle (DVD) : Annabelle Wallis, Ward Horton, Alfre Woodard, John R. Leonetti, Richard Brener, Peter Safran, Walter Hamada, James Wan, Dave Neustadter, Hans C. Ritter, Gary Dauberman: Movies & TV

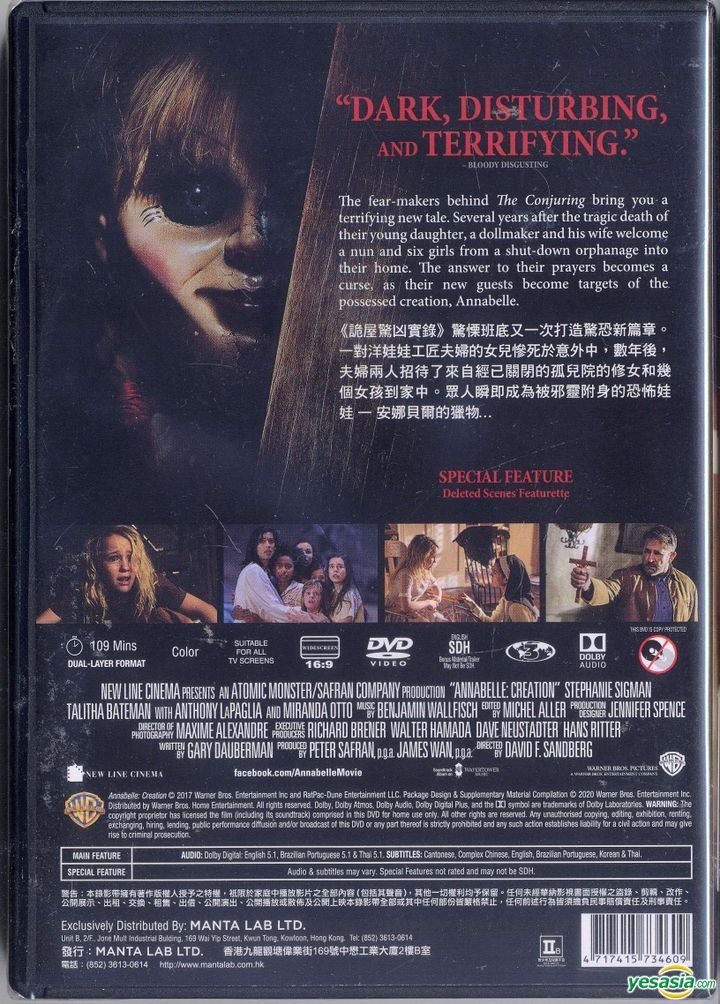

YESASIA: Annabelle: Creation (2017) (DVD) (Hong Kong Version) DVD - Samara Lee, Anthony LaPaglia, Warner Entertainment Japan - Western / World Movies & Videos - Free Shipping - North America Site

![Amazon.com: Loving Annabelle [DVD] [2006] : Diane Gaidry, Erin Kelly, Laura Breckenridge, Jennie Floyd, John Farley, Markus Flanagan, Gustine Fudickar, Ilene Graff, Michelle Horn, Greg Joelson, Katherine Brooks, Loving Annabelle (2006), Loving Amazon.com: Loving Annabelle [DVD] [2006] : Diane Gaidry, Erin Kelly, Laura Breckenridge, Jennie Floyd, John Farley, Markus Flanagan, Gustine Fudickar, Ilene Graff, Michelle Horn, Greg Joelson, Katherine Brooks, Loving Annabelle (2006), Loving](https://m.media-amazon.com/images/I/71H95VRdjJL._AC_UF894,1000_QL80_.jpg)

![Annabelle: Creation [New Blu-ray] With DVD, 2 Pack, Ac-3/Dolby Digital, Dolby - Walmart.com Annabelle: Creation [New Blu-ray] With DVD, 2 Pack, Ac-3/Dolby Digital, Dolby - Walmart.com](https://i5.walmartimages.com/asr/2cd7faaf-0ebf-49ca-be70-faaa4484be66.846e7abde05b76a256df61ba9a23fd72.jpeg)

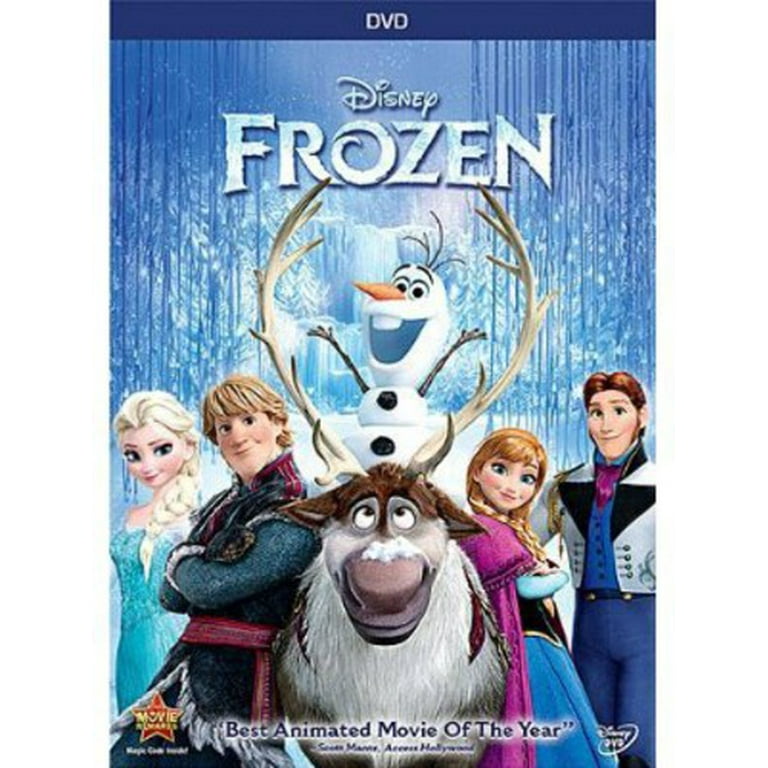

![Frozen II [Includes Digital Copy] [Blu-ray/DVD] [2019] - Best Buy Frozen II [Includes Digital Copy] [Blu-ray/DVD] [2019] - Best Buy](https://pisces.bbystatic.com/image2/BestBuy_US/images/products/6387/6387826_sd.jpg)

![Annabelle (Creation) - Mayhem Collection 2019 [DVD] 8420266024176 | eBay Annabelle (Creation) - Mayhem Collection 2019 [DVD] 8420266024176 | eBay](https://dvdstorespain.es/466132/ebay73f82f0.jpg)

![Amazon.com: Annabelle [DVD] [2014] : Movies & TV Amazon.com: Annabelle [DVD] [2014] : Movies & TV](https://m.media-amazon.com/images/I/81p64opSPRL._AC_UF350,350_QL80_.jpg)

![Amazon.com: Annabelle [DVD] [2014] : Movies & TV Amazon.com: Annabelle [DVD] [2014] : Movies & TV](https://m.media-amazon.com/images/I/41TuhOXDn2L._AC_UF894,1000_QL80_.jpg)

![Amazon.com: Annabelle [3 Film Collection] [DVD] [2019] : Various, Various, Various: Movies & TV Amazon.com: Annabelle [3 Film Collection] [DVD] [2019] : Various, Various, Various: Movies & TV](https://m.media-amazon.com/images/I/81ka-ny0viL._AC_UF894,1000_QL80_.jpg)